40+ ideal debt to income ratio for mortgage

Ad See what your estimated monthly payment would be with the VA Loan. Debt can be harder to manage if your DTI ratio falls between.

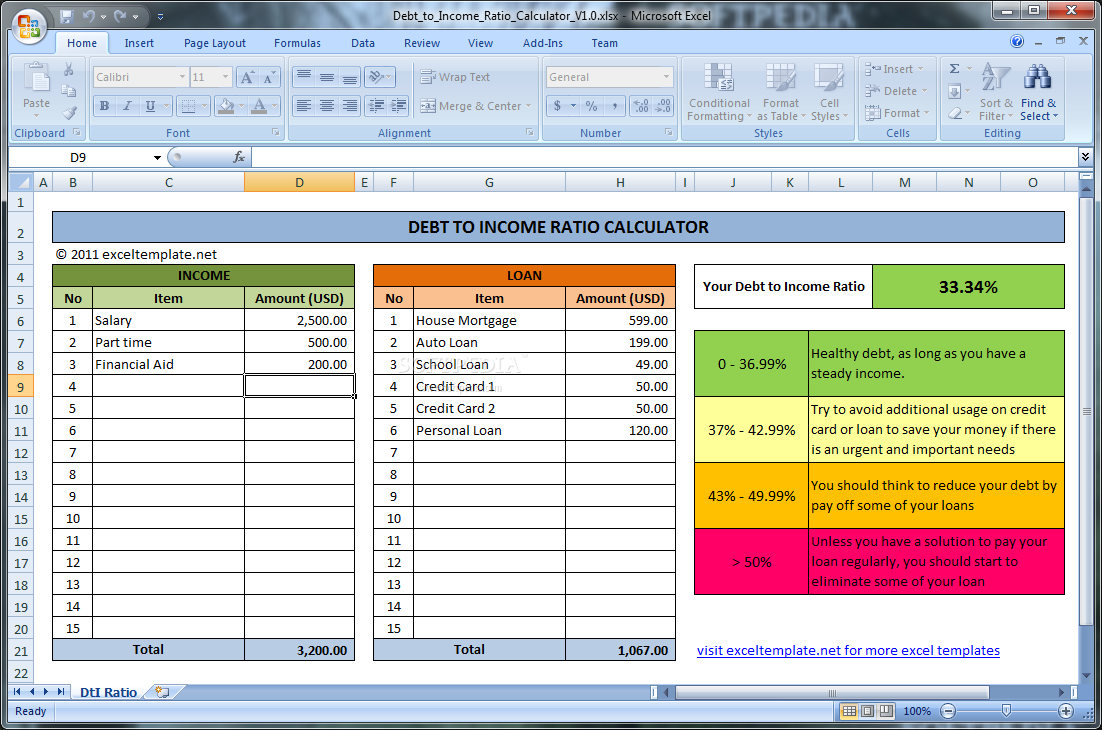

Debt To Income Ratio Calculator 1 0 Windows Download

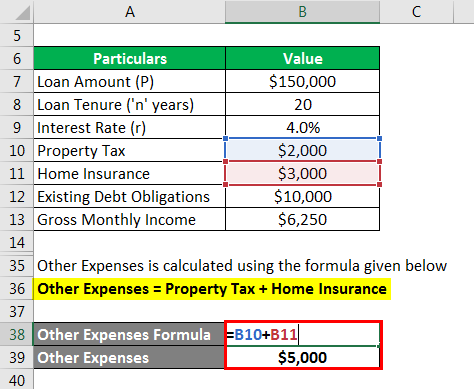

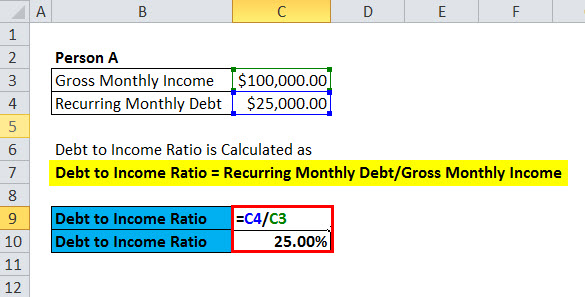

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments.

. Compare Apply Get The Lowest Rates. As a rule the lower your DTI the better for you. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

Web How to calculate your debt-to-income ratio. Monthly debt obligationsdivided byMonthly incometimes100equals DTI For. The Search For The Best Mortgage Lender Ends Today.

Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Use a DSCR loan to purchase investment property without using personal income to qualify.

All loan programs have their own maximum debt ratio allowances as follows. Its a good idea to get your DTI under 40 because anything above 40 could. Web Debt Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage12 For example assume.

Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. Many lenders may even want to see a DTI thats closer to. Web Your front-end ratio usually includes your mortgage principal interest taxes and insurance or PITI.

Ad Easier Qualification And Low Rates With Government Backed Security. Web Over 50. Ad Easier Qualification And Low Rates With Government Backed Security.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web The Standard Mortgage to Income Ratio Rules. Ideally lenders prefer a debt-to-income ratio lower.

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Web Lenders generally view a lower DTI as favorable. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web There is no perfect DTI ratio that all lenders require but lenders tend to agree a lower DTI is better. Web The Ideal Debt-to-Income Ratio.

Ad NASB is a Debt Service Coverage Ratio mortgage lender. Ad See what your estimated monthly payment would be with the VA Loan. Ad Highest Satisfaction for Mortgage Origination.

Its ideal to keep your debt-to-income ratio as low as. Web DTI measures your debts as a percentage of your income. Depending on the size and type of loan theyre issuing lenders set their own.

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments. Web Ideally lenders prefer a debt-to-income ratio lower than 36 with no more than 28 of that debt going towards servicing a mortgage or rent payment. Save Real Money Today.

Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments. Apply Online To Enjoy A Service. A debt-to-income ratio of 50 or higher tends to indicate that you have high levels of debt and are likely not financially ready to take on a mortgage loan.

Heres how lenders typically view DTI. Opportunity to improve Youre managing your debt adequately but you may want to consider lowering your DTI.

Top 3 Mortgage Calculators How Much House Can I Afford Real Estate Decoded

2022 Outlook Q A Crypto Inflation And Energy Transition Vaneck Brazil

What S A Good Debt To Income Ratio For A Mortgage

Strategic Information Transmission In Peer To Peer Lending Markets Fabio Caldieraro Jonathan Z Zhang Marcus Cunha Jeffrey D Shulman 2018

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Fannie Mae Debt To Income Ratio Limit Increase Credit Karma

Total Debt Service Ratio Explanation And Examples With Excel Template

Debt To Income Ratio Formula Calculator Excel Template

What S A Good Debt To Income Ratio For A Mortgage

Apply Online For Personal Loan 3 Variants Up To Rs 35 Lakh Bajaj Finserv

43 Debt To Income Dti Ratio Limit Will Shink The Mortgage Market

Recommended Net Worth Allocation By Age And Work Experience

Recommended Net Worth Allocation By Age And Work Experience

Calculate Your Debt To Income Ratio Wells Fargo

What Is A Good Debt To Income Dti Ratio